Intelligent Room Substitution (IRS)

Increase your direct booking capabilities and direct booking revenues via Intelligent Room Substitution (IRS)

Description

As part of Bookassist’s strategy to increase a hotel’s direct booking capabilities and direct booking revenues, the Bookassist Booking Engine, via Intelligent Room Substitution (IRS), can substitute sold out room types with another designated available room type, at designated time periods which can be set-up by the hotel.

Hotels can maximise direct bookings and increase revenues during busy periods by providing guests with increased availability for longer length of stay bookings using this clever Booking Engine feature called Intelligent Room Substitution (IRS).

IRS enables hotels to substitute sold out room types with another designated available room type, at designated time periods as previously set-up by the hotel. A room substitution is linked to a specified length of stay so that hotels can sell more rooms and for longer stays.

This is valid for Desktop, Tablet and Mobile.

Benefits

This new feature will have a positive impact on your hotel’s direct booking conversion rate. It will allow to manage the availability strategy in a much smarter way and by doing so convert higher levels of direct business, longer length of stay business and as a consequence increase direct booking revenues.

Abandonment rates are expected to decrease since hotels will now be able to make their room inventory available even if the specific room type is not available. With the ‘Min. LOS’ option, it will also help to target longer length of stay bookers and increase their overall average length of stay.

How does it work?

IRS provides bookers with availability for longer length of stay bookings where a night (or nights) of the desired booking may be unavailable.

IRS does this by linking the availability line of a ‘base’ or ‘primary’ room type to the availability line of a superior/higher room type. This means that should the base room type be unavailable for a night(s) of the stay, and if the linked room type has availability for that night(s), then IRS will substitute the unavailable room type (based on the rules which have been pre-set by the hotel).

Check the following example:

Without having IRS enabled:

If a booker was seeking a Classic Room booking in a hotel for a 3 night stay (Fri/Sat/Sun) and if the Saturday night had no availability then the BE would tell the booker that there is no availability = this would result in NO BOOKING, lost business.

With IRS enabled:

For the same booking example above, if there is no availability for the Classic Room for the Saturday night, the BE will check if there is availability at the next room level, the Superior Rooms. If the Superior Room availability line shows availability for the Saturday night then the BE will allocate this room (availability, not the physical room) to the booker for the Saturday night and enable the booking to be processed = this would result in a 3 NIGHT BOOKING, direct business won which would otherwise have been lost.

By configuring some simple rules hotels must decide which available room types will substitute those that may become sold out. These rules will usually apply to longer length of stay bookings but this is completely up to the hotel.

The substituted room availability will be decreased from the inventory, and the hotel will then decide how to best manage their inventory and their guests at the front office/front desk level.

The booker will NEVER be aware of IRS or that from an inventory point of view that an unavailable room has been substituted with an available room.

The booker will NEVER change rooms. The inventory and guest(s) occupancy is managed by the hotel.

How hotels know when IRS is applied:

Bookers will never see any information related to IRS, not during the booking process nor within the confirmation page or in the booker confirmation email. Only the hotel will be aware of this substitution.

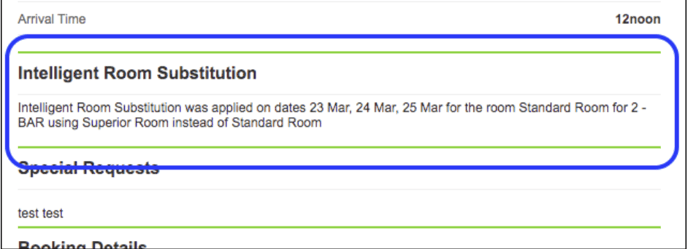

In the hotel's email confirmation there will be displayed a new section called: ‘Intelligent Room Substitution’ where the system will identify when IRS has been applied to a booking:

- It will identify which rooms have been booked through IRS.

- A new line for each date and room booked through IRS will be displayed.

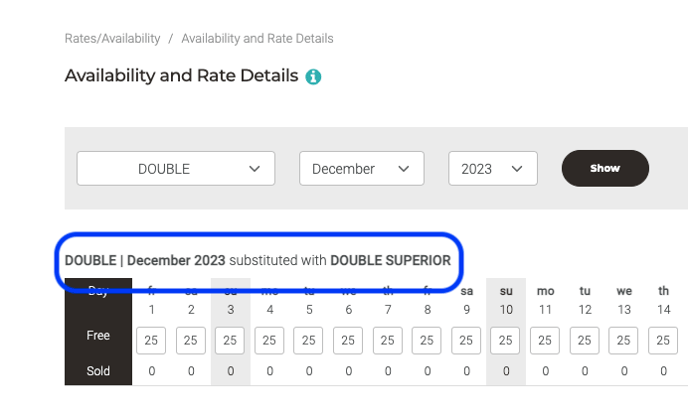

Hotels can also directly identify where IRS is being applied within the Booking Engine Extranet.

How to Set-up IRS Rules:

Step 1: Hotels must decide the the IRS strategy as follows:

- Which rooms types will substitute the ‘base’ or ‘primary’ ones

- The minimum stay needed to apply IRS

- Which rate plans should IRS be applied

Step 2: Hotels must inform Bookassist Support Team

Once the strategy is decided, hotels just need to inform L1 Support Team at support@bookassist.com in order they can do the configuration needed.

Step 3: Internal Configuration by Bookassist staff

Bookassist Support Team will do the setup needed in order hotels can manage IRS in the Booking Engine Extranet.

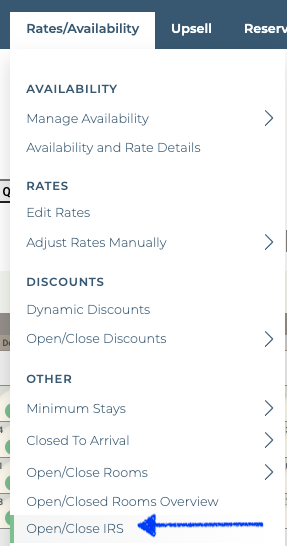

Step 4: Open/Close IRS in the Booking Engine Extranet

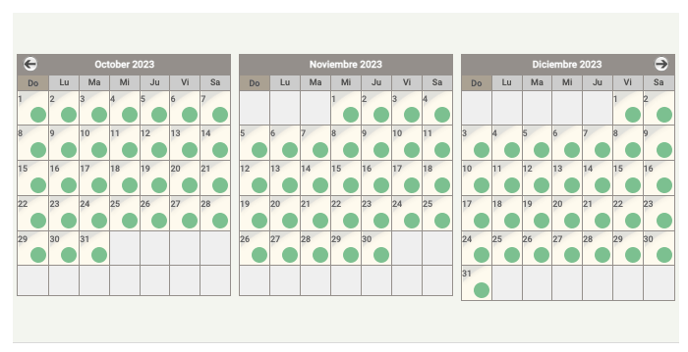

IRS is open by default. Hotels must set their strategy by closing IRS for those days when they are not interested in making IRS available.

This must be done in Booking Engine Extranet → Rates/Availability → Open/Close IRS

Do you have any questions or doubts? Do not hesitate to contact your Client Success Manager for more information.